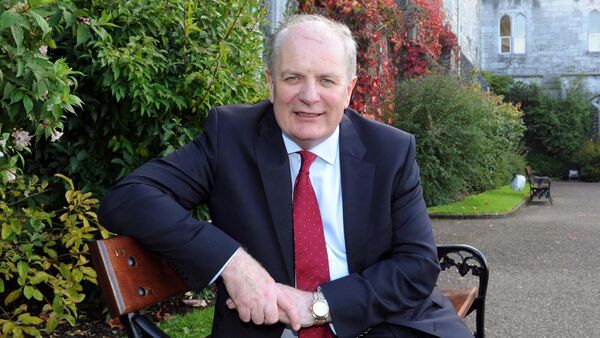

While Covid-19 forced companies to switch to remote working very quickly and the migration has gone reasonably well, financial advisor Eddie Hobbs says remote working is also proving to be a ‘double-edged sword’ and in many ways a ‘big firm nirvana’.

He says the sudden death of the centralised office will see many job losses – big companies will move ‘back-office jobs’ or ‘support services’ to the EU periphery to countries like Romania and Greece as multi-nationals interpret working-from-home as somewhat of “an unexpected bonanza”.

He said a number of multi-nationals in the big pharma sector are already in the early stages of moving their labour force to countries where homeworking can be got more cheaply.

“It is part of their global cost-saving strategy so while R&D, manufacturing and the more specialised areas which require high skill sets are safe there will be jobs losses in support services like security, canteen, finance, HR, middle management, IT, call centre, customer service etc.”

Support staff, he pointed out, can often comprise as much as 50% of the entire workforce of a pharmaceutical company.

Remote locating within the EU he explained is perfectly legal within the Treaty of Rome and part of Single Market Competition.

On the positive, Ireland he said should benefit enormously from Britain exiting the EU – “from a tax and labour perspective we are the ideal landing zone for foreign direct investment going into the EU. These businesses however could decide to have their back-office facility elsewhere because we have proven it can work”.

The fact that Trump is no longer in The White House is he said hugely positive going forward……the fact that there is a pipeline of vaccines coming is extremely encouraging.

“The problem is by the time the vaccines take effect and despite the best efforts of all the countries in the world and of the medical establishment it is going to be quite some time into next year before we can actually begin to talk about Covid-19 in historical terms.

“It means we will be a year or maybe a year and a half into the crisis when we have to deal with what I’m calling the ‘flood and fracture phase’.”

This, he says, is when we can expect to see the collateral impact of everything that has gone on and we are going to have to deal with that he says before any real recovery phase can even begin in a reshaped world thereafter.

The scale of this ‘flood and fracture’ phase he says “appears to be somewhat lost on the Government.

“Not everything can be saved by adding ever more debt, and the belief that this can be done on an open-ended basis and without consequences is fanciful. Hundreds of thousands of workers are on emergency cash, but how many of their business employers are failing without the buoyancy of revenues?”

It is inevitable, he said, that many of these business owners face bankruptcy.

Also without money coming in the door, many small and medium enterprises (SMEs) in particular are unable to pay their bills – their rent, their suppliers, their bank repayments and so on. The Central Bank of Ireland (CBI) reported recently Irish SMEs have lost more than €10bn in revenue as a result of the economic disruption caused by Covid-19.

“These are stark figures and they make sense. SMEs worldwide would not have cash reserves and if they do, it is usually an overdraft from a bank so a huge amount of non-performing loans will be coming at the banks and they will start hitting early next year”.

Eddie says we could be facing another banking crisis: “It won’t be anything like the scale of the banking crisis in 2008 when Lehman Brothers went ‘super nova’ and caught everybody cold.

“This time around the institutions are in place, the capital is available, the responses are rehearsed and we know it is coming but we could still see banks fail.

“The scale of insolvency of big companies is quite significant and it is easy to see why when you see what is happening to businesses like casinos, cruise liners, airlines, hotels, restaurants and office parks – these sectors are getting hammered by collapsed revenues.

“If they don’t have enough cash on their balance sheets, which most of them don’t, they will default on their loans and all of that is happening in the background at the moment.”

For more on latest news in the hiring space, make sure you checkout our recruitment news section.

If you are a recent graduate or just someone seeking to explore the job market, make sure to check out the different recruitment opportunities with Recruit Ireland: